What Does Top 30 Forex Brokers Mean?

What Does Top 30 Forex Brokers Mean?

Blog Article

Facts About Top 30 Forex Brokers Revealed

Table of ContentsLittle Known Questions About Top 30 Forex Brokers.The Best Guide To Top 30 Forex BrokersNot known Factual Statements About Top 30 Forex Brokers Little Known Questions About Top 30 Forex Brokers.How Top 30 Forex Brokers can Save You Time, Stress, and Money.How Top 30 Forex Brokers can Save You Time, Stress, and Money.Top Guidelines Of Top 30 Forex BrokersThe 15-Second Trick For Top 30 Forex Brokers

Like various other instances in which they are used, bar graphes give even more price info than line graphes. Each bar chart stands for someday of trading and has the opening cost, highest possible cost, cheapest cost, and shutting rate (OHLC) for a trade. A dashboard on the left represents the day's opening rate, and a similar one on the right represents the closing rate.Bar charts for money trading help investors determine whether it is a customer's or seller's market. Japanese rice traders initially used candlestick charts in the 18th century. They are visually a lot more attractive and simpler to read than the graph types defined above. The top portion of a candle light is utilized for the opening rate and highest possible rate point of a currency, while the lower section suggests the closing rate and cheapest price factor.

What Does Top 30 Forex Brokers Mean?

The formations and forms in candle holder charts are made use of to determine market instructions and movement. Several of the extra common developments for candle holder graphes are hanging man - https://www.pubpub.org/user/joseph-pratt and shooting star. Pros Largest in terms of daily trading quantity in the globe Traded 24 hr a day, five and a half days a week Beginning capital can quickly increase Usually follows the same policies as regular trading A lot more decentralized than standard supply or bond markets Cons Take advantage of can make foreign exchange professions extremely volatile Leverage in the series of 50:1 prevails Needs an understanding of financial principles and indications Much less regulation than other markets No earnings generating instruments Forex markets are the largest in terms of everyday trading volume around the world and consequently supply the a lot of liquidity.

Financial institutions, brokers, and suppliers in the forex markets enable a high quantity of utilize, meaning investors can manage large settings with reasonably little money. Take advantage of in the variety of 50:1 prevails in forex, though also greater amounts of take advantage of are available from specific brokers. Nevertheless, leverage should be made use of cautiously due to the fact that many inexperienced traders have experienced significant losses using more take advantage of than was required or sensible.

The smart Trick of Top 30 Forex Brokers That Nobody is Talking About

A currency trader requires to have a big-picture understanding of the economies of the numerous nations and their interconnectedness to realize the fundamentals that drive currency worths. The decentralized nature of forex markets implies it is much less regulated than other economic markets. The extent and nature of regulation in foreign exchange markets depend upon the trading territory.

Foreign exchange markets are among one of the most fluid markets worldwide. They can be less volatile than other markets, such as real estate. The volatility of a specific money is a feature of multiple variables, such as the politics and business economics of its nation. Consequently, occasions like financial instability in the kind of a payment default or inequality in trading connections with another money can result in substantial volatility.

Top 30 Forex Brokers - Questions

Currencies with high liquidity have an all set market and exhibit smooth and predictable price action in response to exterior events. The U.S. dollar is the most traded currency in the world.

Top 30 Forex Brokers for Beginners

In today's information superhighway the Foreign exchange market is no more entirely for the institutional financier. The last one decade have seen a boost in non-institutional investors accessing the Foreign exchange market and the benefits it provides. Trading platforms such as Meta, Quotes Meta, Trader have been established particularly for the personal financier and academic product has actually become quicker available.

Facts About Top 30 Forex Brokers Revealed

Foreign exchange trading (forex trading) is an international market for acquiring and marketing currencies. At $6. 6 trillion, it is 25 times bigger than all the world's securities market. Foreign exchange trading determines the exchange rates for you can try this out all flexible-rate currencies. Consequently, rates alter constantly for the currencies that Americans are probably to make use of.

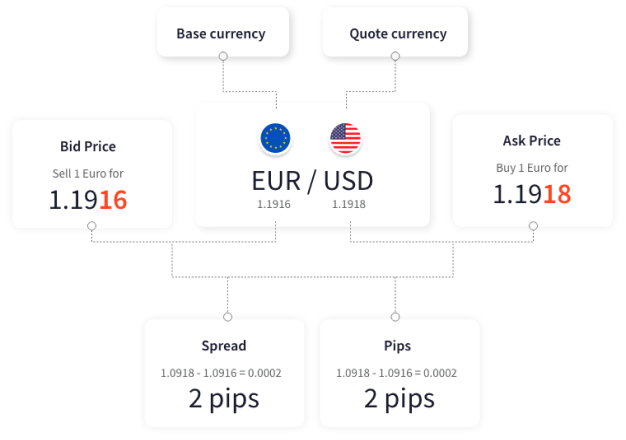

All money professions are done in pairs. When you offer your currency, you get the repayment in a various money. Every tourist that has actually obtained international money has actually done foreign exchange trading. When you go on trip to Europe, you exchange dollars for euros at the going price. You offer united state

More About Top 30 Forex Brokers

Place deals are similar to exchanging money for a trip abroad. Spots are agreements in between the trader and the marketplace maker, or dealer. The investor gets a specific currency at the buy price from the market manufacturer and offers a different money at the marketing rate. The buy price is rather greater than the asking price.

This is the transaction price to the trader, which subsequently is the revenue gained by the market maker. You paid this spread without understanding it when you traded your dollars for international currency. You would certainly notice it if you made the deal, terminated your trip, and after that attempted to exchange the currency back to bucks right away.

3 Easy Facts About Top 30 Forex Brokers Described

You do this when you think the currency's value will certainly drop in the future. Businesses short a currency to secure themselves from threat. Shorting is very risky. If the currency increases in value, you have to purchase it from the dealership at that rate. It has the very same pros and cons as short-selling stocks.

Report this page